In recent weeks, the coronavirus has never been far from the headlines. At the start of March, there were more than 87,000 confirmed cases of Covid-19 with almost 3,000 deaths. While the vast majority of the cases and fatalities have been in mainland China, the virus has now spread to more than 60 countries.

One of the most immediate consequences of the coronavirus outbreak has been the impact on global stock markets.

Last week saw a fall of 11% in the value of shares in London, and a fall of 8% in New York. Other markets around the world have also seen sharp falls. While you may be concerned about the short-term volatility of the markets, it’s important to remain calm and focused on your goals.

Why are the markets reacting in this way?

- The closure of Chinese factories has led to concerns about production in the rest of the world. Apple has already warned over the impact of shutdowns in China, while carmaker Jaguar Land Rover has been flying parts out of the country in suitcases. Shortages of components will almost certainly have a knock-on impact in the West.

- A reduction in travel. A travel ban means Chinese tourists are staying at home, while many major carriers have warned of a severe reduction in demand. EasyJet and the owner of British Airways have announced emergency measures, including cancelling flights, changing the size of planes used on routes and freezing pay.

- A reduction in global demand. Dozens of companies, from mining firm Rio Tinto to software giant Microsoft have reported that they will not hit sales targets in 2020.

Lessons from previous epidemics

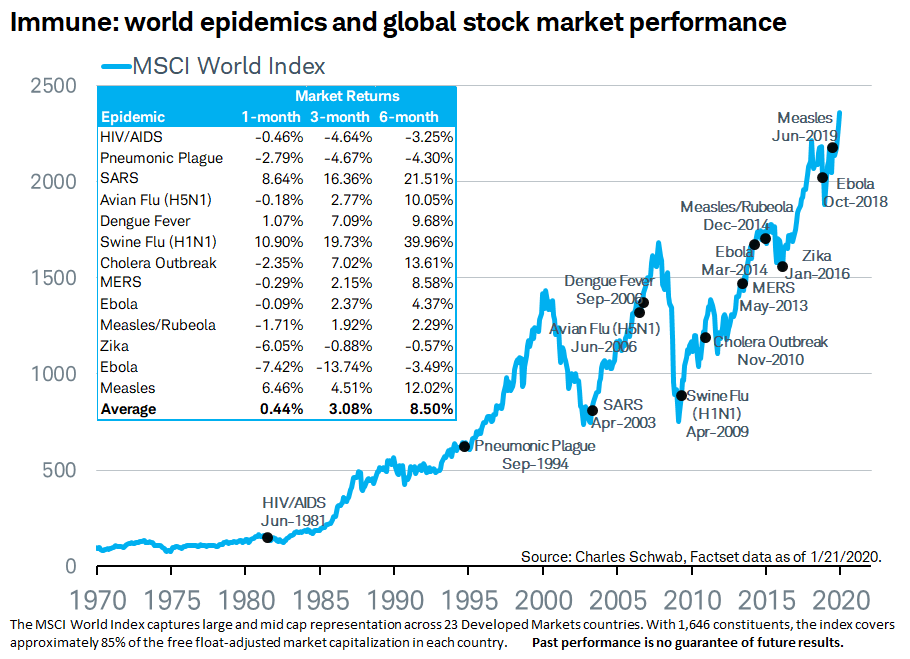

Earlier this year, Charles Schwab research looked at the impact of previous epidemics on world markets.

Considering outbreaks including SARS, H1N1 Swine Flu and Ebola, the conclusion was simple:

“The global economy and markets have been relatively immune to the effects of past viral epidemics — even when the global economy was especially vulnerable to a shock. A short-term dip in stocks tended to be followed by the continuation of the upward trend… investors may have little need to take action if their portfolios are diversified and aligned with their long-term plan.”

Keep calm and carry on

Whenever you invest in equities, short-term volatility is something that you have to expect. Everything from inflation figures to Donald Trump’s social media updates can affect what happens to markets, and so on any given day or week, there is a chance that prices will fluctuate in the short term.

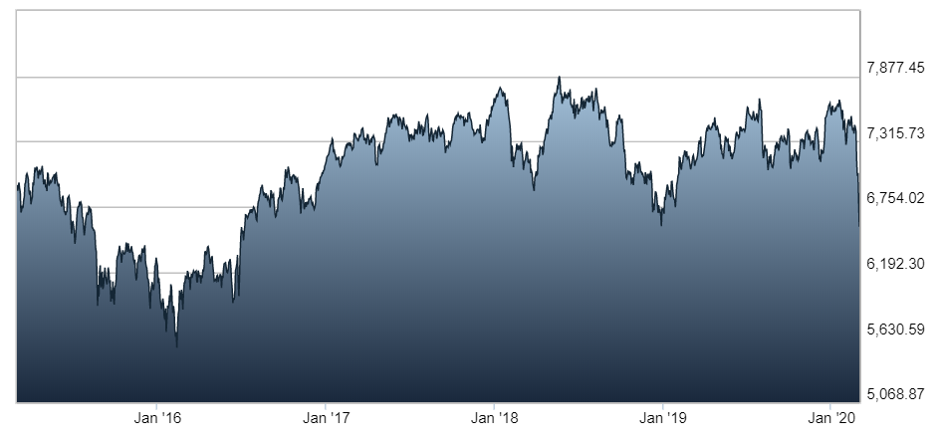

However, over time, stock markets tend to provide growth. The chart below shows the value of the FTSE100 over the last five years. You’ll see that the closing level at the end of February is still significantly higher than the value of the index just four years ago.

Source: London Stock Exchange

It is always worth remembering that saving is a long-term objective.

As Mark Fawcett, the Chief Investment Officer or auto-enrolment pension provider Nest says: “Pension saving is a long game – people can be saving for up to 40 or even 50 years, so it’s important to keep looking at the bigger picture, rather than short-term events.

“Younger savers should comfortably ride out short-term fluctuations and at Nest we take steps to protect members’ pots as they get closer to retirement and are more likely to need their money sooner.”

- Your goals are likely to be the same as they were a week or a month ago. Our investment strategies are designed with the long term in mind, and this naturally considers periods of both positive and negative returns.

- You have a diversified portfolio. The fall in the value of the FTSE 100 is not the same as the fall in the value of your portfolio. Our clients have diverse portfolios that include exposure to other asset classes, for precisely this type of situation.

- Now is the worst time to panic. While our emotions might take over at this time, reacting to a fall in the markets can be a disaster. You potentially turn a paper loss into a real loss, and a range of studies have found that this is one of the main reasons why investors lose money.

Short-term stock market volatility is normal. While it may feel difficult now – we certainly feel this too – it is part of a long-term investing strategy.

The final word goes to Charles Schwab who, earlier this year, undertook research into previous disease pandemics and their impact on the global economy. Their conclusion was:

“The global economy and markets have been relatively immune to the effects of past viral epidemics – even when the global economy was especially vulnerable to a shock. A short-term dip in stocks tended to be followed by the continuation of the upward trend.”

If you have any queries about the impact of Covid-19 on investments and pensions, please get in touch.

Please note: Investments carry risk. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.